Apple presents Apple Card, the reinvented credit card

A new service, initially available only in the USA, to make payments and keep track of your expenses: it is Apple Card, the new virtual credit card designed by Apple.

Apple has announced Apple Card, a new payment service that is based on a virtual credit card created by Apple and which also aims to help the user develop a more conscious management of their finances.

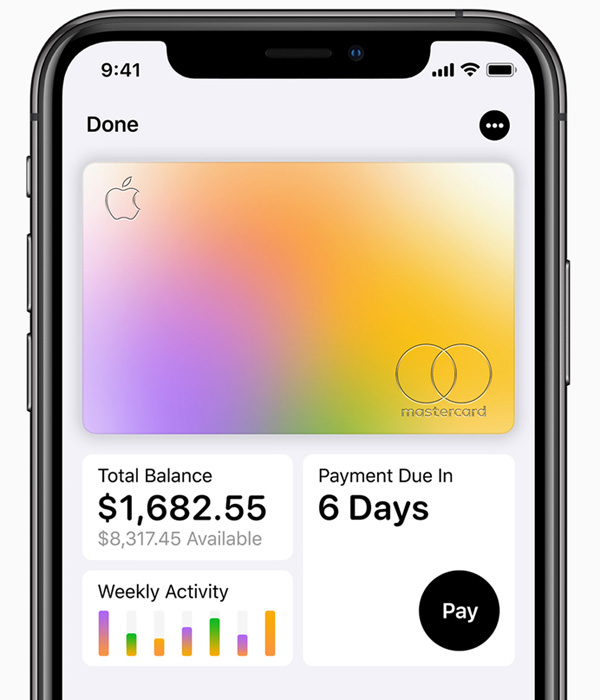

Apple Card is integrated into the Wallet app and offers those who are already accustomed to using Apple Pay the ability to manage their credit card directly through Apple. The service will be available starting in the summer and initially only for users residing in the USA.

This is a complete transformation of the credit card user experience, which also includes the elimination of commissions and encourages the user to pay less interest. Apple Card also includes a loyalty and rewards system called Daily Cash, which gives the user a percentage of payments made every day, without any limit.

Jennifer Bailey, Apple Pay’s vice president for Apple, introduced Apple Card: ” It is based on the success of Apple Pay and offers new experiences only through the iPhone.

Apple Card is designed to help customers lead a healthier financial life, which starts with a better understanding of their spending so that they can make more accurate choices with their money, transparency to help them better understand how much it costs them to defer payments over time and ways to help them pay off their debts “.

All the expenses are then classified by category, with colored labels, and with a clear reference to where they were spent and with which operator so that it is easy to review and organize them. Apple Card also offers a weekly and monthly report.

We said just above the loyalty and rewards program: Apple Card users receive a percentage of their expenses through the Daily Cash mechanism. Every day, for any cost and for any amount: 2% for expenses made through Apple Pay, 3% for purchases made in Apple stores (physical and virtual) and 1% for actual expenses with the new physical Apple Card that the Apple has thought to meet the expenses incurred by merchants that do not yet accept Apple Pay.

In this case, it is a titanium card, with a laser engraved name, and no other code or information, which is stored in the Apple Wallet. The funds ” recovered ” through the Daily Cash mechanism can be used freely to pay for whatever you want, and even transfer them to friends and relatives via Apple Messages.

Apple has managed to design and offer this service thanks to the collaboration with Goldman Sachs and Mastercard, which offer the support of an issuing bank and a global payment network. Transactions are authorized through Face ID or Touch ID, and all payment information is securely stored in the Secure Element that Apple Pay uses for all its operations.

Apple is keen to point out that the architecture created to manage payment information does not allow it to become aware of what the user purchases, and how much he spends.

There is no information at this time to suggest when and if the Apple Card service will also be made available to users outside the US.